PDF) On the Simulation and Estimation of the Mean-Reverting Ornstein- Uhlenbeck Process Especially as Applied to Commodities Markets and Modelling | dario girardi - Academia.edu

Simulating Electricity Prices with Mean-Reversion and Jump-Diffusion - MATLAB & Simulink - MathWorks Deutschland

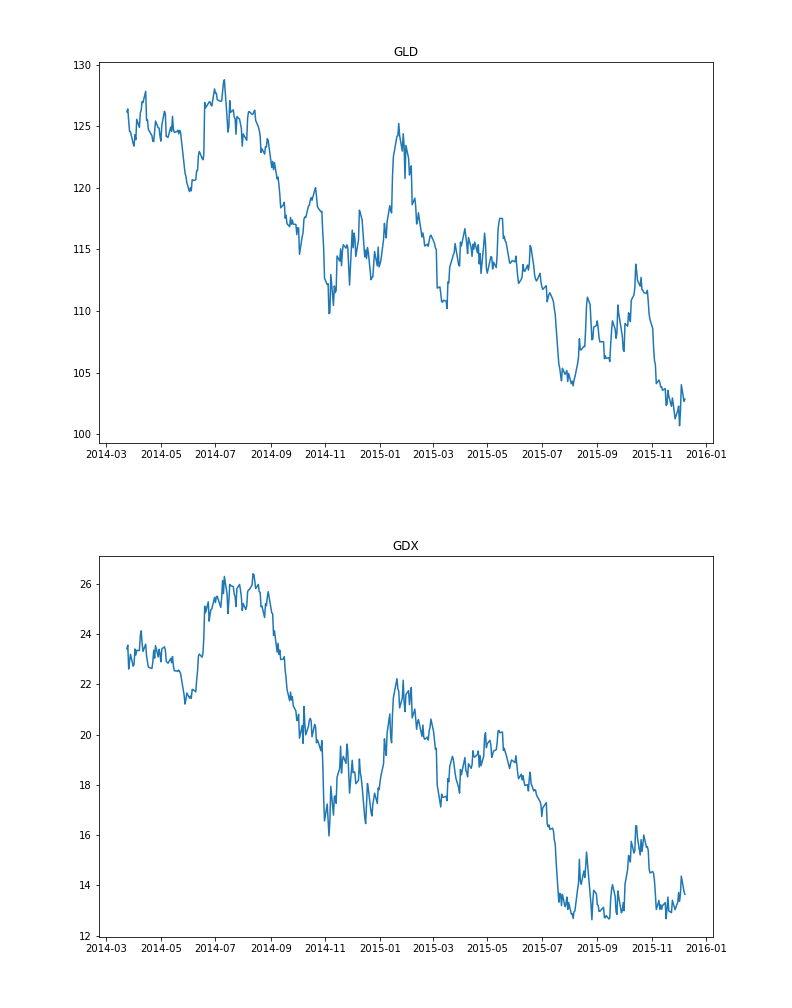

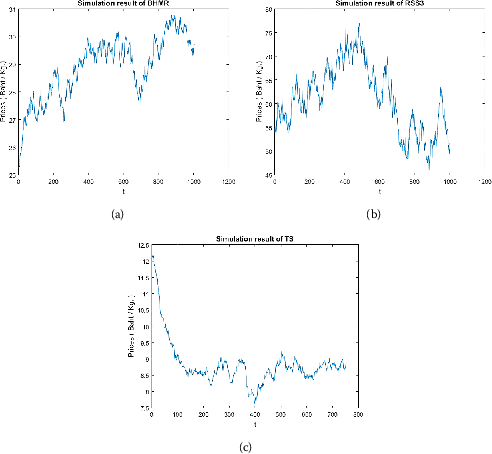

An application of Ornstein-Uhlenbeck process to commodity pricing in Thailand | Advances in Continuous and Discrete Models | Full Text

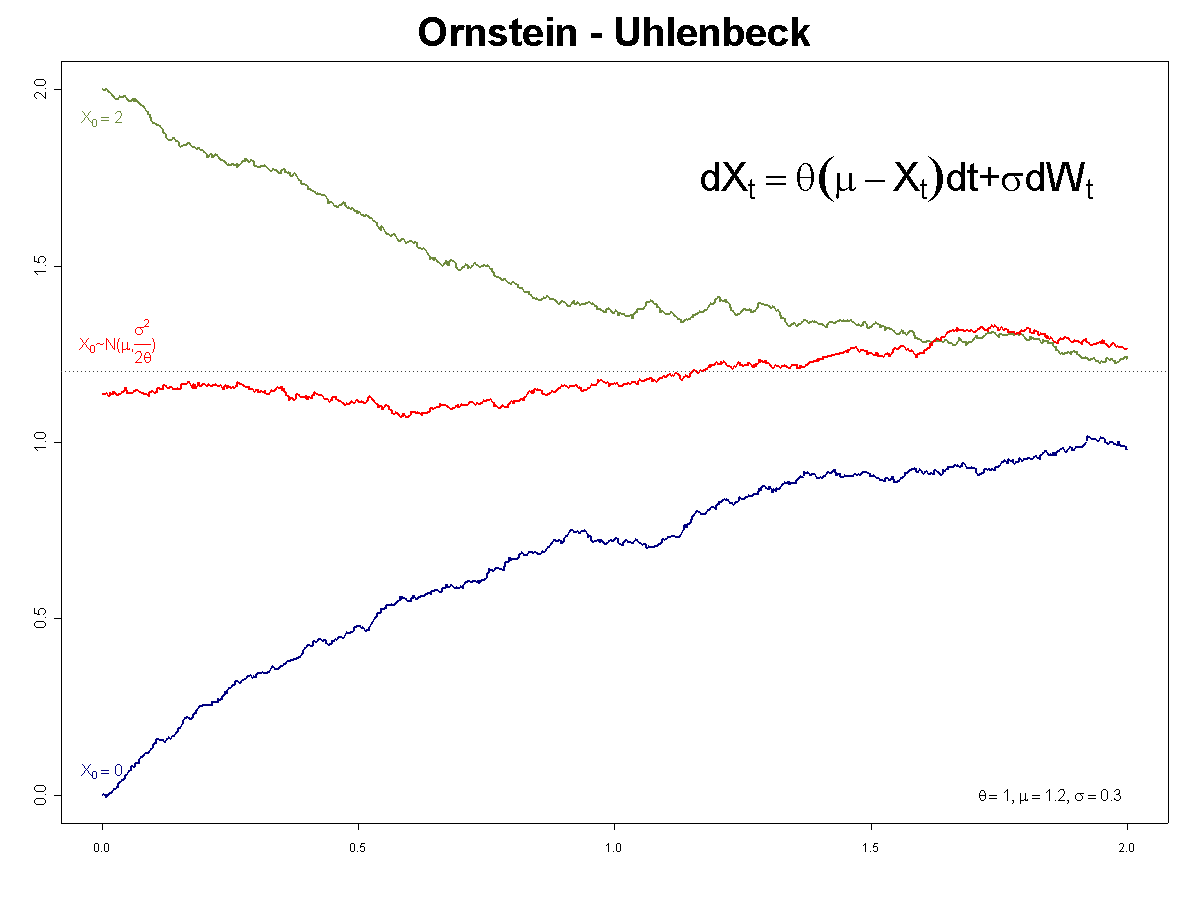

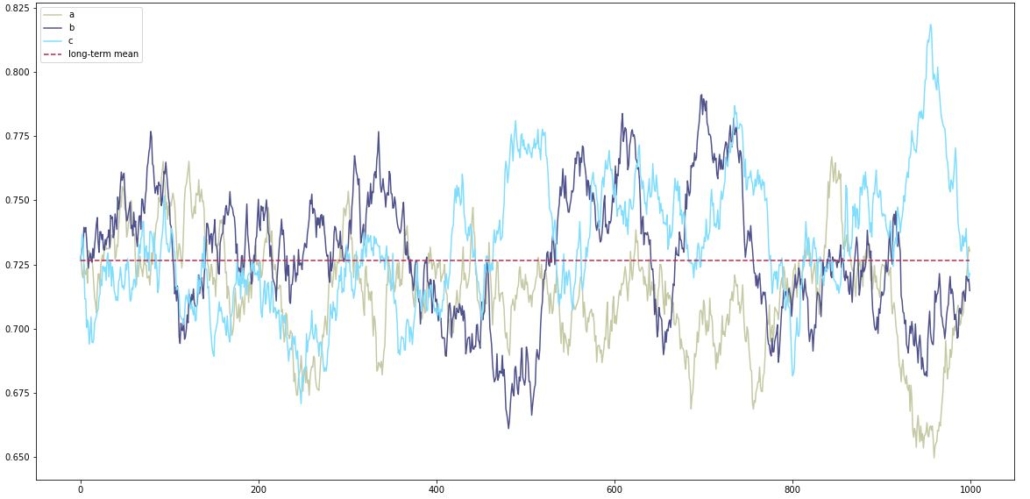

Stochastic Differential Equations —The Ornstein-Uhlenbeck Process | by Ryan Howe | Star Gazers | Medium